FinTech Innovation: Introduction

They say, out of every crisis comes an opportunity. And for the FinTech sector, the 2008 Global Financial Crisis provided just such an opening.

The Crisis of 2008 demonstrated the fallibility of the traditional financial sector, leading consumers to lose confidence in its’ unreliable institutions and services. The industry needed a radical alternative.

In response, the rapid growth of FinTech innovation has offered a much-needed challenge to the mainstream financial establishment.

FinTech innovation is based on a customer-centric approach to financial service delivery. Above all, it seeks to maximise the customer experience and value. And it has inspired a range of specialised services, through transparent products, polished customer journeys, and greater availability of services.

As Albert Pumpurs, a UX specialist describes, “FinTech startup founders think and see finances through customer’s eyes. They choose to be all about the customer and create products they want to use. Banks, on the other hand, focus on better loans, fees, branch locations”.

In this blog, we’ll explore FinTech innovation. We’ll look at how they build excellent customer experience through carefully curated UX/UI design and their product offering.

FinTech Innovation: Customer Experience

FinTech innovation seeks to simplify financial products and make them more accessible to customers. To explore how FinTech firms do this, we’ll look at the beginning of the customer journey.

One of the first rules of user experience design is to remove as much cognitive load as possible. Cognitive load is defined as ‘total amount of mental effort that is required to complete a task involving processing information’.

To create a seamless user experience it must be instantly evident to users what they are looking at and reading.

In short, the key to great user experience is simplicity: simple language, simple design.

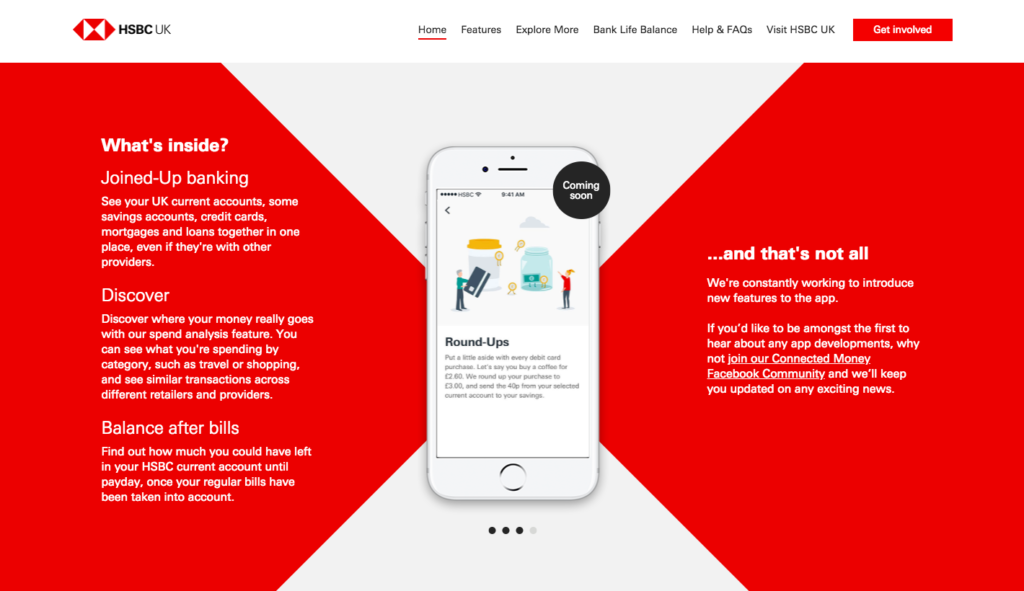

On the HSBC homepage, the text is 137 words long, the headers aren’t clear about the features on offer, and the user needs to read the description further to understand. For instance, ‘Discover’ doesn’t actually indicate that the app offers a spend analysis.

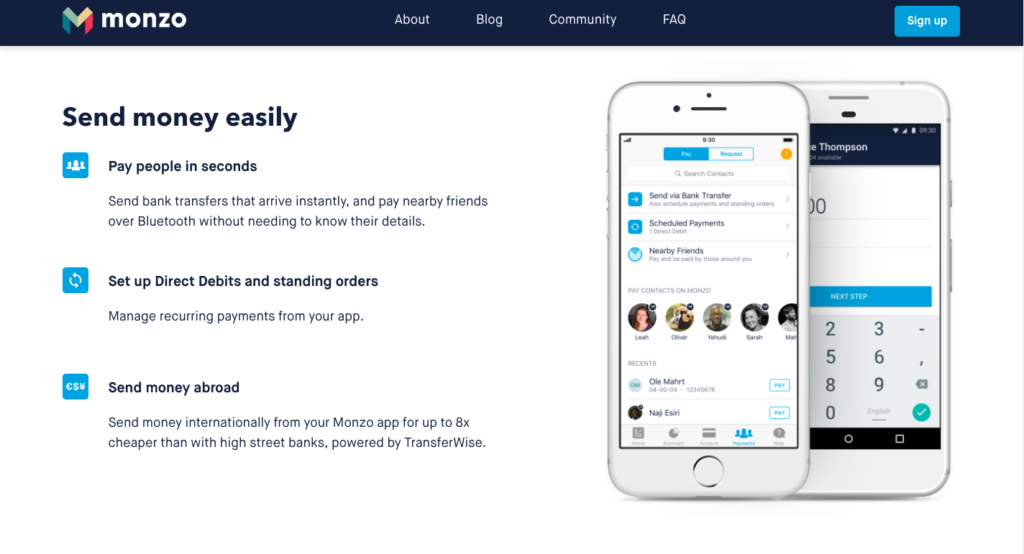

By comparison on Monzo’s website, there are three features that are explained in 61 words. Each header informs the reader about each feature.

Most importantly, Monzo uses strong, emotive language and shows a tangible benefit to the user: ‘Pay people in seconds’ or ‘Send money… 8 x cheaper’.

In contrast, the text on HSBC’s website focuses on the product in a way that creates no connection to the reader – ‘Joined-Up Banking’ is simply a feature of the app. Even the title of the section ‘What’s inside?’ indicates the app being the subject, rather than the customer.

Readability

It’s worth noting that Monzo optimised for the F-reading pattern. There is a large and visible title for the section ‘Send money easily’, and at each point, the website is easy to scan across. This means there is no need to stop and read in-depth to get a clearer understanding of the firm’s offering.

Finally, in terms of their website design, both HSBC and Monzo offer clean visuals. However, HSBC doesn’t showcase what the app actually looks like. Instead of the user interface, we see a graphic with another feature explained. Monzo on the other hand, let us see a screenshot from their app. This enables the customer a greater insight into their potential experience. And interestingly, their interface looks somewhat similar to Facebook Messenger app. This helps to foster a feeling of familiarity and ease of use.

In this way, the FinTech offering puts the user experience at the centre of their design. And it’s by no means merely a question of aesthetics. Doing so creates products and services that are easy to use and understand. And in turn, this has led millions of customers to take up their offering.

FinTech Innovation: Product

FinTech innovation provides long-lasting value to customers by removing friction from the customer experience wherever possible. One of the ways they do this is by being highly specialised in terms of the services provided.

Traditional banks typically offer all forms of accounts, loans and advice. While in contrast, most FinTechs choose a very narrow space within which to operate. This specialisation allows them to refine their products through high-level personalisation and innovation.

Personalisation

There are many ways in which FinTechs personalise their products, from the application of AI to custom integrations. For instance, Cleo is an intelligent money assistant. Powered by AI, Cleo connects with your bank accounts and analyses your spending, and based on this information can then help you budget and save money. In addition, if ever you need support you can chat to Cleo via Facebook Messenger at any time and get a reply instantly:

In contrast, the way most traditional banks help their customers save money is limited. Typically this amounts to setting up a direct debit to a savings account and to get the advice you need to get an appointment in a branch.

Custom integrations with other pieces of software is another method of personalising the customer experience. The aim here is to allow the automated flow between applications to save customers time and effort. An excellent example of such a solution is Xero, a fully versatile accounting platform that users can integrate with over 400 external applications, and which can be accessed at any time, from any device.

Indeed, according to a recent report published by Xero, such innovations mean that 59% of small businesses don’t think they’ll need an accountant in 10 years’ time. A large part of this is the result of improved accessibility and workflows. Nowadays, business owners can complete a broad range of tasks themselves. At the same time, the research also shows that cloud-based accounting systems free up accountants’ time through automation; therefore, they can spend more time on giving advice to their clients and improving their financial well-being.

Transparency

A very clear example of the disruption FinTechs have been causing in the financial sector can be seen in terms of transparency in currency exchange markets.

In April 2017 it was revealed that Santander charge six times as much for currency exchange as TransferWise, and in turn that the popularity of FX FinTech firms seriously threatens the profits of traditional banks:

“They [Santander executives] were told that while TransferWise, a relatively new start-up in the money transfer business, was charging €64 to move £10,000 from the UK to Spain, Santander charged €394 – six times as much. New entrants were “attacking the profitable slices” of its [Santander’s] money transfer business, and if the bank charged the same as TransferWise, its revenue would collapse from €585m to €95m, a fall of 84%”. And this is at a time when for Santander, 10% of its global profits come from foreign currency exchange.

Transfer rates

The way traditional banks make such staggering profits is through adding a hefty markup to the interbank exchange rates. While they may advertise their FX as 0% commission, the hidden cost may be up to as much as 10%.

In this way, a common selling point of FX FinTechs like Revolut, TransferWise and Azimo is honesty and transparent pricing. Revolut and TransferWise operate on the mid-market or interbank exchange rate and as such customers pay less than 0.5% (or less) as a markup; meanwhile, Azimo charge 0.1%-2.25% plus £1.99 for an FX transfer.

Offerings like this demonstrate how the FinTech focus on customer experience and value represents a significant shift in the way financial services are delivered – as is revealed by the rising FinTech involvement in FX markets, there are tangible, monetary-value benefits available to customers, and this stands such firms out as a stark alternative to the otherwise cynical and damaging approach of traditional finance.

Making products and services more available

Many FinTechs differentiate themselves by providing services to people who would otherwise be rejected by traditional banks. For instance, there are a large number of FinTech firms dedicated to providing alternative streams of business funding. From crowdfunding (Crowdfunder, Kickstart) to peer-to-peer lending platforms (Funding Circle, Zopa), businesses now have more options than ever to get the capital they need. Such alternatives are not only more accessible but are often cheaper than traditional bank loans too.

In addition, businesses are able to access more than just finance through such alternative funding sources – market exposure, free PR and showcasing products and services to potential investors are just some of the many advantages available.

Oculus, a VR company, stands out as an excellent success story of such alternative funding streams. Having run a Kickstarter campaign in 2012, Palmer Luckey and his team were able to raise almost $2.5 million to finish Rift, their fully immersive VR headset. This sum was ten times more than the original target set, and two years later when Rift was still in the prototyping stage, Facebook offered to pay $2 billion in cash and stock to acquire the company.

Of course, such success stories are rare and plenty of businesses fail to raise the necessary funding. However, FinTechs lower the entry barriers to open or scale up a business. This disruption brings about greater equality of opportunity within the market, encouraging entrepreneurship across the sector.

Where does this leave us?

FinTech innovation comes from a dynamic synthesis of the fields of finance and digital technology. FinTech firms are shaking up the financial establishment. By improving customer experience, FinTech firms represent an invaluable point of competition to the way financial services are delivered. This is felt not just in terms of better products and services, but in real monetary benefits to customers too.

Like all sectors that derive inspiration from the ongoing digital technology revolution, the potential within this space is near limitless; not just for the innovations we can expect in the coming years, but the employment opportunities that are being created now.

If you’re interested in roles in FinTech, UX/UI or technology products, please reach out – we at Ignite Digital Talent are currently working with some of the leaders in the FinTech industry, and will be recruiting heavily in the coming months for any bright minds and talents looking to work in this exciting and dynamic space.