In this article from Ignite Digital, we’ll explore the unique potential for blockchain disruption in Insurance.

The insurance industry has come a long way since – around a thousand years ago – Chinese seafaring merchants were pooling funds to pay for a group member’s capsized ship.

But nowadays, in the face of the ongoing digital technology revolution, the sector looks increasingly opaque and inefficient. There are too many phone calls, contracts on paper, and claims prone to errors and requiring human supervision. Inefficient processes compound the general complexity of the sector and the challenges of handling risk.

More broadly, the traditional insurance sector faces numerous challenges. From finding growth in mature markets and poor customer satisfaction (where less than 1/3 of insurance customers are happy with their providers), and issues in compliance and transparency, to finding operational efficiencies, and tackling cybersecurity and issues of fraud (5-10% of all insurance claims are fraudulent).

This is an intense range of pressures on the insurance industry. To address them, it requires significant change and investment. Otherwise, the sector has little chance of remaining competitive in the digital age.

Enter, InsurTech.

Increasing demand for accessible, low-cost services has given rise to a rapidly growing InsurTech sector. New entrants are seeking to transform the relationship between consumers and insurers through technological innovation.

The innovation we’re most excited to see used in the space is the blockchain. As a report at McKinsey describes, there is a unique potential for blockchain disruption in insurance.

This is why 81% of insurers are familiar with blockchain, expecting widespread adoption through the industry, and 100% are planning on integrating it into their production systems by 2021. Already, there are numerous start-ups engaging in blockchain disruption in insurance.

Blockchain Disruption in Insurance: “The greatest revolution since the advent of the Internet”.

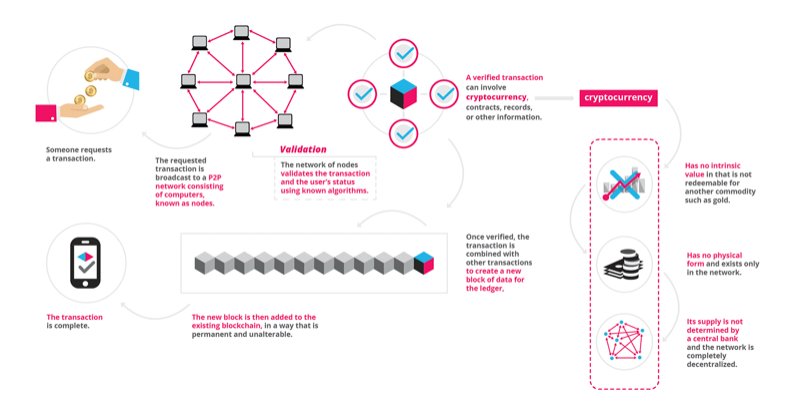

Developed in 2008 by a group known by the pseudonym Satoshi Nakamoto, blockchain was initially developed for the digital currency Bitcoin, although its application has spread significantly since then. Four key characteristics provide the foundations for blockchain technology.

Decentralised validation:

Blockchain is a decentralised technology by design. Rather than being stored in a single location, millions of computers host the blockchain simultaneously. Operating on a peer-to-peer basis, anything that happens in the network is a function of the whole. Whenever new data is placed into blocks, it’s only added to the blockchain after a consensus is reached on the validity of the action. This means the network lives in a state of consensus. It’s a self-auditing ecosystem of a digital value, continuously reconciling every transaction at regular intervals.

Redundancy:

Blockchain is continuously replicated on all or at least a group of nodes in the network, meaning there is no single point of failure. By storing data across a network, blockchain eliminates the risks that come with centrally holding data – there are no central points of vulnerability, making it near-impossible for hackers to simulate or manipulate processes of validation.

Immutable storage:

Each block is linked to the previous block in the chain. This means it’s impossible for hackers to subsequently change blocks. As they’d have to manipulate any succeeding blocks and the majority of their replications. Data is registered on the chain by creating a digital fingerprint using hash functions with a date and time stamp. Any attempt to change the data will be apparent because the new fingerprint won’t match the old. Combined with the chaining of blocks, the stored data becomes immutable, and transaction history is fully transparent.

Encryption:

Digital signatures based on pairs of cryptographic private and public keys enables network participants to authenticate who initiated a transaction, owns an asset, signed a smart contract, or registered data on the blockchain. This means blockchain can be used as a system of static recording and as a dynamic registry for the exchange of assets and payments; as well as the verification of dynamic information.

Peer-to-Peer (P2P) model turns traditional insurance on its head.

The most exciting example of this unique potential for blockchain disruption in insurance comes from the P2P model of insurance. In P2P insurance, we may be witnessing the beginnings of a radical transformation within insurance more broadly.

Traditional insurance is built on a model that requires policyholders to pay a premium to the insurer to be covered against losses. If losses don’t occur, the insurer keeps all premiums. This incentivises the insurer not to pay claims, creating shorter-term horizons.

The P2P model turns traditional insurance on its head.

The P2P model is based on risk sharing networks made up of groups of individuals who pool premiums to insure against risk. Members of these groups have similar needs – often small groups of friends and family – who team up and assume responsibility for each other’s risk profiles, encouraging individuals to keep their own risk as low as possible for the benefit of the group. In the case of a claim, the contribution is directed to those affected; and the remaining funds are returned to the group. In particular, this model mitigates the conflict that otherwise arises between insurer and policyholder, as their fees are a fixed percentage of contributions or of claims paid.

We’ve watched this model be taken to new levels through the application of blockchain technology.

It does so by utilising blockchains four characteristics of decentralised validation, redundancy, immutable storage and encryption. Specifically, through the use of blockchain technology and self-governing models, policyholders are empowered to collectively manage all insurance functions, setting rules, accepting new members, and deciding on claims and reimbursements. This means, once a premium is set, members first put their contributions into an escrow account. In the event of a claim, pay-out is approved by a voting mechanism to determine the amount paid. Then any remaining money is redistributed to the group automatically. This approval mechanism helps to deliver a level of transparency not previously available in the insurance sector.

At the same time, blockchain ‘smart contract’ technology means insurance policies can be written with less ambiguity, fewer points of contention, and enables insurers and consumers to verify the location of people and goods in the real world. In turn, this enables all administration to be performed through the decentralised ledger, using smart contracts to guarantee payment from insurer to the customer in the case of an event.

In the traditional insurance sector, companies perform the equivalent processes manually. But now in InsurTech, they’re performed within the group, by software and smart contracts. The result is a system that is simpler, more efficient and leaner. These gains lead to a cheaper service and lower premiums.

But it’s also significant because the P2P model represents a way to re-establish trust between insurers and consumers, as the blockchain algorithm operates autonomously and can’t be manipulated by either party for gain, enhancing security in the face of rising fraud and cybersecurity threats.

Blockchain Disruption in Insurance Technology: P2P in Action

The InsurTech P2P model, driven by blockchain technology, is a major disruptive force in the insurance space. And it offers the potential to resolve many of the problems the traditional sector otherwise faces.

Riding this wave, we can see increasing numbers of P2P InsurTech start-ups springing up around the world, operating in different sectors, with varying requirements, and premium policies.

One of our favourite companies operating in this space is VouchForMe, covering car, home, and business insurance.

By using blockchain technology, VouchForMe enables users to ask friends and family to vouch for them to share insurance deductibles and pay lower premiums. By vouching, guarantors make a financial commitment to cover a part of the deductible in case of fault or claim. Utilising the power of social connections, this digitises trust and encourages good behaviour. It means that risk is shared by dividing the full amount of the deductible amongst the group.

Blockchain Disruption in Insurance: A Unique Disruptive Potential

InsurTech firms like VouchForMe are amongst the first to apply blockchain technology in the insurance sector. Already, they’re demonstrating the unique potential for blockchain disruption in insurance.

The adoption of blockchain technology is only just beginning. But in the coming years, we’ll see the rapid spread of this technology in insurance. Through doing so, the potential is such that we could see the space utterly transformed as a result.

For a sector that has traditionally been inefficient, opaque and riddled with poor incentives, this transformation is timely and necessary. Whether we needed another reminder or not, it’s yet another testament to the ongoing disruptive majesty of the digital technology revolution, rapidly unfolding before our eyes.